Structural Changes in the German Travel Market – Part 2: Airline

Structural Changes in the German Travel Market – Part 2: Airline

14.12.2018

The changes in the airline market are derived, on the one hand, from the general trend towards more individualized and data-driven sales and, on the other hand, from the separation of rigid production models.

Thesis 1: Distribution models of legacy carriers are approaching low cost carrier models

Thesis 2: Aggregration approaches and forms continue to evolve

Thesis 3: Full Content and Neutral Display are losing importance

Thesis 1: Distribution models of legacy carriers are approaching low-cost carrier models

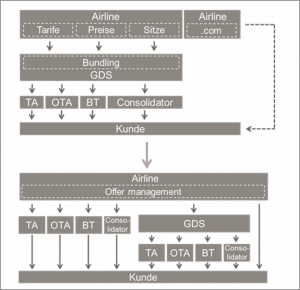

In the airline environment, existing distribution models are breaking up. In future, airlines will increasingly distribute their services to end customers and selected distribution partners, independent of intermediaries and technical distributors.

An essential aspect here is the future development of the yield management of the airlines. Instead of an exclusive opening and closing of tariff classes, the trend is towards a nutzenorientierteren supply control, which is geared to a reduced number of core rates and a plurality of differentiating service elements.

With the aim to achieve greater independence from the Global Distribution Systems (GDS) and retain end customers and relevant partners more closely, the vertical integration of the airlines to the sovereignty of the product configuration will be extended (this was in the past, historically in the GDS).

Conclusion:

Like the low-cost carriers, legacy carriers take over a significant part of their margin-optimizing value creation by reintegrating the entire offer configuration.

Thesis 2: Aggregation approaches and forms of airlines continue to evolve

The task of the aggregation is to collect and display content from a variety of different sources. There are two different perspectives on the nature of the aggregator role.

On the one hand, the aggregator is assigned a neutral role, which is connected with the goal of creating a high degree of transparency and comparability of service offerings. On the other hand, it is expected from an individual customer or service provider perspective that it is exclusively a technical aggregator function whose task is to link and forward both general and individually negotiated products or tariffs.

In view of the evolving aggregation approaches and forms, a further fragmentation of content is to be expected as well as an increasing importance of multi-sourcing on the basis of open technological standards in airline sales. This redefines the roles of different market participants in the flight environment:

GDS providers are aggregating NDC content and working to make their revenue models more flexible

In Leisure Travel, agency multi-sourcing platforms and consolidators will play an increasingly important role

In particular, innovations in the environment of NDC allow new aggregators simplified market access

Classic distribution partners are developing into system providers

Conclusion:

In airline sales, roles, tasks and earnings models of market participants are shifting – the entry of new market participants is to be expected.

Thesis 3: Full content and neutral display are becoming less important

The focus of the content discussion is currently in particular the provision of full content in the sense of a full range of services / products / tariffs offered by the airlines for all distribution partners or aggregators and maintaining the comparability of this content for the end customer by a so-called neutral display.

The way the airlines have embarked shows that in the future we will be talking about fragmented content instead of full content and differentiated display approaches instead of a neutral display.

Both aggregators and travel distributors will have to face this fragmentation of flight content through a multi-sourcing strategy. This ensures that neither the aggregator in availability nor the end customer faces any disadvantages in terms of comparability. In addition, a broader connection (several direct connections) allows access to richer content, which airlines can play primarily via their own, NDC-based channels.

It must be questioned to what extent the current specification of the “neutral display” in terms of relevance and operability in the future corresponds to the needs of the customer. Due to the current structures (Metasearcher etc.) there is a very high number of offers, which prevent a neutral display presentation in the previous form. The question arises as to whether the customer does not wish for significantly more individuality in the performance presentation and delivery. A more flexible presentation of results is achieved by sorting the result list based on individual parameters. These can help the industry not only sell price driven

Conclusion:

With fragmentation of the flight content and individualization of the configuration of the performance, the added value of the sales performance and the available service offers come to the fore.